Business Models for Small Startups. Best ideas for 2023

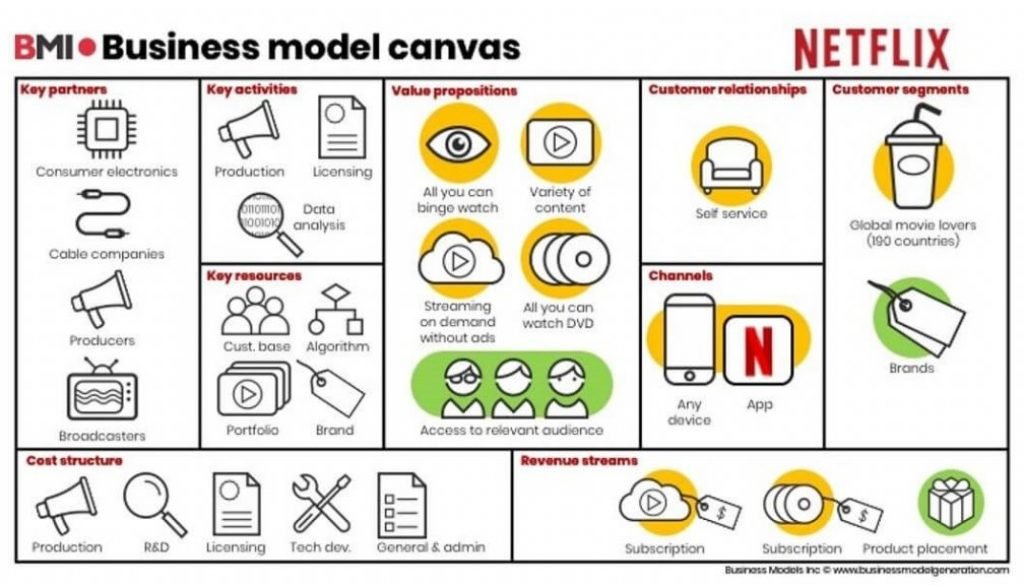

A Business Models are the means by which a company generates its revenue. It includes elements such as customer segmentation, delivery channels, and key partners. It is not just a description of how a company makes money, but also a way of explaining how it creates value for consumers. For example, a company can charge customers a certain amount of money for a product, but charge differently for a service. It is important to understand your target market before you develop your business model.

Table of Contents

Disintermediation

While disintermediation is a great idea, it is not without its risks. Manufacturers may be able to offer their products and services at lower prices, but they are unlikely to provide the same quality as specialists. For this reason, it is critical for manufacturers to evaluate the viability of disintermediation and determine whether it will provide the same level of service at a lower price. If the manufacturer is successful in eliminating the need for intermediaries, it could help to reduce costs by enabling them to deliver the product or service to the consumer. Business Models

Disintermediation is the process of eliminating middlemen in the supply chain, which increases efficiency and accessibility to the end customer. Ultimately, disintermediation helps create a market where producers can produce the products and services that consumers want at a lower price. This phenomenon is gaining momentum with the emergence of the internet. Nevertheless, it must be understood that disintermediation does not always work in every industry.

The financial markets have seen a disintermediation of their services, with banks acting as an intermediary between investors and low-risk financial instruments. Disintermediation has spread to other industries, including retailing. In this case, the model is business-to-consumer (B2C), and the internet has become the central hub of the process. This model is also called direct selling and has created a new frontier in retailing. Business Models

disintermediated business model

A disintermediated business model is a type of business models that removes middlemen from transactions. It may allow a consumer to purchase products directly from a manufacturer or wholesaler. In other instances, it may allow an investor to buy stock directly from a company. This approach may save time and money, but it does not necessarily cut the cost of delivering products and services. Further, it is not always easy to implement in a business environment. Business Models

Hoteliers must learn to adapt to disintermediation in their business model. To remain competitive, hotels must offer services that exceed the expectations of their customers. By taking advantage of the latest trends, hospitality professionals can adjust their marketing strategies to provide better services. It also makes the business more attractive to customers and can lead to general revenue growth. But before disintermediation becomes too successful for hotels, it is important for hospitality businesses to take a step back and analyze their current Business Models.

Marketplace

The marketplace business models are very attractive one, mainly because it allows businesses to easily expand their client base. A marketplace allows users to purchase products or services for a fixed monthly fee, with the option to cancel at any time. It can be profitable, but you must have an appealing value proposition to attract users. This may mean offering free trials to new users. Additionally, you can offer a variety of subscription plans and capabilities to users.

In this business model, the middleman or platform provider provides access to the platform and charges a fee to vendors and buyers. This model attracts more vendors and allows the marketplace to provide a valuable experience. In addition, a marketplace can handle all logistics and payment processing, which means it can offer more advantages to both buyers and vendors. It is also easier to scale if the platform has low overheads compared to a traditional online store.

The commission-based business model is an attractive one for B2C and other non-commerce markets, but won’t be sustainable when selling high-priced products or services. The commission-based business model has two main challenges: it must not drive away customers, and it must be competitive with other marketplaces. Another challenge is pricing. You can set a percentage or fixed commission, but this doesn’t mean that you must use the same fee. Business Models

One way to scale this business model is to start with the simplest form of two-sided marketplaces. For example, Craigslist, Upwork, and Uber are examples of marketplace operators that create value for end-users. The users of these marketplaces are usually looking for products or services that are offered on the platform, and the marketplace operator is creating convenience for them. This builds the demand side and drives the providers. This leads to a “tribe effect” where buyers and sellers congregate to meet their needs. Business Models

based marketplace

A subscription-based marketplace works by charging recurring fees to its users. This model is attractive to marketplace owners because it allows them to predict their revenue month-to-month. This model is also great for marketplaces with a loyal and trusting client base. However, the platform must offer enough value to both the vendors and users to justify a subscription. Besides, subscription-based marketplaces often have limited tools to facilitate transactions. If the users don’t see enough value in the platform, this may lead to “leakage” in the platform.

The commission model is another way to generate revenue for a marketplace. This is a popular online marketplace business model. The commission is based on a fixed percentage of the payment to the seller. This fee may be a small percentage, but it helps the platform earn revenue. The marketplace receives revenue from each conversion, and the commission is usually the smallest, but this model can be the most profitable. It also allows businesses to expand their reach while giving customers a more streamlined experience. Business Models

Pay-as-you-go

The Pay-as-you-go business method is a consumption-based model in which a consumer pays only for what he or she uses. This is a different business model than subscription-based models, which require users to pay in advance. Pay-as-you-go targets budget-conscious consumers who want to be in control of their spending. This model can be a good fit for a variety of businesses, including small startups.

The Pay-as-you-go business method is used in utilities like electricity and water meters. These devices use metric measurements to measure usage and automatically calculate when a user is due for payment. This model is used in many countries around the world and provides consumers with full control of their payments. Users are able to pay only for the services they use, and they can even pay as they go. Companies are able to track consumer usage patterns, and can personalize their services based on the needs of their customers. Business Models

Another benefit of Pay-as-you-go is its ease of use. It makes it easy for a customer to pay only for what they need. This means that they will not waste time on registering or paying for a service that they do not use. Moreover, the Pay-as-you-go business model is scalable and can grow with the company. This means that a company can scale it up without compromising its customer base.

In contrast to flat-rate pricing, the Pay-as-you-go business method offers a flexible solution to the problem of rising costs. It offers the flexibility to charge more for additional credits if they need them. This allows businesses to justify higher charges. The pay-as-you-go model is similar to the pay-per-use billing method. However, this business model has its disadvantages.

While a subscription-based business model offers the advantage of predictable costs and predictable revenue, a Pay-as-You-Go business model presents some challenges. It is harder to build customer loyalty and predict revenues, which are crucial for a successful business. It is also harder to plan for the future because the customers who use your services can only pay for what they need. The subscription-based pricing method offers predictable revenue, but its limitations make it difficult for a business to forecast its future financial position.

While pay-as-you-go businesses can benefit from frictionless payment experiences, they are still relatively expensive until they reach scale. It is therefore necessary to create a compelling business case before launching Pay-as-You-Go. Additionally, as the business model evolves, so must the customer experience. It is important to ensure that the customer experience is consistent and seamless. Once the customers have become accustomed to the concept, the business model can be scaled.

Another advantage of the Pay-as-You-Go business model is that it improves customer retention rates. The subscription fee makes customers stick with the business for a longer period of time. With a subscription model, a business can also budget more effectively because it will know how much revenue it can expect to generate. With a subscription-based business model, you can even continue to operate without any new subscribers.